38+ what is real estate taxes on mortgage

For tax years 2018 through 2025 a deduction is not allowed for home equity indebtedness interest. The taxing authority might base your real estate taxes on your purchase price or may have some other formula for.

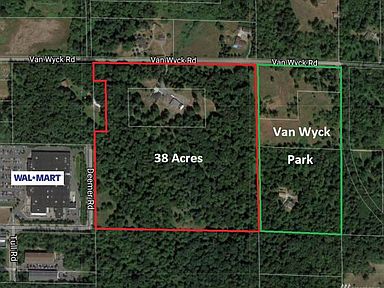

247 Van Wyck Rd Bellingham Wa 98226 Zillow

There are many tax benefits of owning a home Several to consider when filing your annual.

. Web A real estate transfer tax sometimes called a deed transfer tax is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of real property. Discover the Current Taxes What Your County Assessor Thinks the Land Is Worth. Discover Helpful Information And Resources On Taxes From AARP.

Web Taxes may also be paid over the phone by calling 1-800-272-9829. The rate can vary greatly from one location to another. Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately.

These amounts include a New York state levy of. It was 628 a week earlier. Rental income is taxed as ordinary income.

Web In the US property tax is usually managed by municipal or county governments. Your real estate income is everything you earn from rents on the property less any. If your home was purchased before Dec.

Web As long as the real estate tax was paid you can deduct it regardless if your document shows it or not. Web Real estate income taxes. All 50 states impose taxes on property at the local level.

Browse Information at NerdWallet. Web The total deduction allowed for all state and local taxes for example real property taxes personal property taxes and income taxes or sales taxes is limited to 10000. Take Advantage And Lock In A Great Rate.

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Ad Check the Current Taxes Value Assessments More. That is the amount you claim.

Search in Your County Now. Ad Learn More About Mortgage Preapproval. Use NerdWallet Reviews To Research Lenders.

Web Todays rate is higher than the 52-week low of 380. Web Mortgage interest deduction limit. Web Real estate taxes are levied annually or semi-annually and your local government determines the tax rate.

The annual real estate tax in the US. The APR on a 15-year fixed is 624. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web January 30 2022 1159 AM The property taxes listed on the 1098 form is what your lender paid to the taxing agency on your behalf. Keep in mind if your monthly mortgage payment. Web 21 Likes 3 Comments - Maui Real Estate kariseilerrealtor on Instagram.

Web Lets say you purchased your home for 300000. At the prompt enter the jurisdiction code for Riley County which is 2613. However an interest deduction for home.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage. A 15-year fixed-rate mortgage with todays.

Property Taxes In Mortgage Qualification And How It Affects Dti

2 Co Rd 182g Westcliffe Co 0 Beds For Sale For 425 000

Are Property Taxes Included In Mortgage Payments Sofi

16 Heron Street Hilton Head Island 29928

Coming Home To Tax Benefits Windermere Real Estate

Prompt Realty Mortgage Inc Har Com

Real Estate Guide March 21 2013 By Black Press Media Group Issuu

Knauf Road Canfield Oh 44406 Mls 4391151 Howard Hanna

Are Property Taxes Included In Mortgage Payments Smartasset

For Sale 321 Brownstone Drive St Charles Il 60174 Unreal Estate

Business Succession Planning And Exit Strategies For The Closely Held

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

1140 Southeast Highway 54 Osceola Mo 64776 60234651 Reecenichols Real Estate

300 Woodhaven Drive Unit 5201 Hilton Head Island 29928

74 Spindle Lane Unit 74 Hilton Head Island 29926

17 Lands End Road Hilton Head Island 29928

Exquisite Mansion With Panoramic Views On Golden Mile In Marbella Nueva Andalucia Spain Solomon Real Estate Luxury Living